At a Glance

- Recyclables declining in value is real. Cardboard, plastics, and metals are worth far less than a year ago.

- Multiple factors drive the drop. Lower demand, oversupply, and high energy costs all play a role.

- Food businesses feel the squeeze. Lower value from cardboard and plastics means higher waste costs.

- Smart operators adapt. Reduce packaging, keep recyclables clean, and renegotiate hauling contracts.

Yes, we will address this question at the very top. Recyclables are, in fact, losing value.

Let’s all remain calm.

The recycling market is undergoing significant changes right now — and it’s creating unexpected ripple effects for businesses everywhere. Materials like cardboard and plastic bottles, which used to bring in decent money, are now worth a fraction of what they were just a few years ago (we’ll get to the specifics later). If your business creates packaging waste, like most food businesses, you may see changes in your waste management costs.

It’s kind of like when your favorite coffee shop suddenly raises prices — annoying, yes, but not exactly a crisis (some may argue otherwise). This market shift creates exciting chances for businesses. Those willing to think creatively about their packaging strategy can benefit…and not the “Let’s package everything in jars shaped like pandas” kind of creative (though we don’t want to stifle your artistry).

At Inline Plastics, we’ve been in the fresh food packaging business for over 55 years. We’ve watched markets swing, regulations evolve, and industry trends shift. We don’t have all the answers, but after five decades of helping food businesses with packaging, we’ve gained valuable insights. We’ve learned how to adapt when market conditions shift.

This analysis will explain the underlying factors behind the changes in the recycling market. You’ll discover how these shifts could affect your operations. Most importantly, you’ll find ways to turn this challenge into a competitive edge (for real). The market may be shifting, but innovative businesses consistently find ways to adapt – and sometimes even emerge ahead, regardless of their interestingly shaped jars.

How Much Are Recyclables Worth in 2025?

The downturn in the recyclables market isn’t a simple blip; it’s a major collapse across several material categories. We know this sounds daunting, but let’s break it down by material.

The downturn in the recyclables market isn’t a simple blip; it’s a major collapse across several material categories. We know this sounds daunting, but let’s break it down by material.

Corrugated cardboard, a staple waste stream for restaurants and foodservice operations, has plummeted to $72 per ton in June 2025, representing a $6 monthly decline and a staggering $36 drop from the previous year’s $108 per ton, according to Resource-Recycling.

Mixed paper has suffered an even more dramatic fate, with current trading prices around $39 per ton — nearly half the $70 per ton value from just twelve months ago. This represents a 44% decline in value that’s reshaping how businesses approach paper waste management strategies.

The plastics sector hasn’t escaped unscathed. PET bottles and jars, commonly used for beverage containers and food packaging, are averaging $0.14 per pound, down from $0.16 last month. This monthly decline may look minor, but it points to a larger issue. The value of plastic recyclables is decreasing. All foodservice operations that handle bottled beverages are affected.

The metal recycling market tells the most dramatic story of all. Steel scrap prices have dropped to their lowest point in twelve years, according to experts at Rockaway Recycling. In March 2024, steel prices fell hard and fast. Some types of recycled steel lost $19 per ton, while others dropped $17 per ton in just one month.

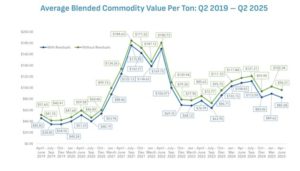

Source: NERC: Northeast Recycling Council — Click to view in detail.

Here’s what happened: We wish we could say there was an evil wizard who disliked the environment, and we can blame them. But here’s the truth: Turkey used to purchase a significant amount of American scrap metal. However, they’ve stopped buying as much because their own factories no longer require as much steel. When a big buyer like Turkey steps back, it creates a problem. There’s now too much scrap metal sitting around with nowhere to go. This oversupply pushes prices down even further.

What Are the Root Causes of the Value Collapse?

Again, we wish there was a wizard to blame. Understanding why recyclables are losing value requires examining several interconnected factors. Global economic conditions play a primary role, with reduced manufacturing demand in key markets such as China and Turkey directly impacting recyclable material consumption. During an economic downturn, factories often scale back production to match lower consumer demand. As output decreases, they require fewer raw materials — including recycled content.

Again, we wish there was a wizard to blame. Understanding why recyclables are losing value requires examining several interconnected factors. Global economic conditions play a primary role, with reduced manufacturing demand in key markets such as China and Turkey directly impacting recyclable material consumption. During an economic downturn, factories often scale back production to match lower consumer demand. As output decreases, they require fewer raw materials — including recycled content.

Supply chain disruptions continue affecting material flows, creating imbalances between collection and processing capacity. Many recycling facilities boosted collection during high-value times. Now, they deal with an oversupply, which lowers prices.

Energy costs also influence recyclables processing. Higher electricity and fuel prices raise the cost of turning waste into usable products. This makes recycling processors less willing to pay premium prices for incoming materials.

Additionally, virgin material prices have declined in some sectors, making recycled alternatives less economically attractive. When new plastic resins or fresh paper pulp become more affordable, manufacturers often opt for virgin materials. This shift lowers the demand for recycled options. It’s like dominoes made of “economic problems” falling onto one another, crashing simultaneously. Again, remain calm. We’ve got a plan for you.

Impact on Foodservice Operations

Here’s where things start to really get dicey. Food businesses face unique challenges due to declining recyclable values. Restaurant chains and foodservices often generate a significant amount of cardboard waste from deliveries. Many have relied on selling recyclable materials to offset the costs of waste hauling.

With corrugated cardboard values dropping $36 per ton annually, a large restaurant generating 10 tons of cardboard monthly faces a $3,600 annual revenue reduction from this single waste stream. Think about what that money could have gone toward (spoiler: a lightly-used jet ski with your company’s logo on it — perfect for cruising lakes during BBQ season. You’re welcome for the idea). For multi-location operators, these numbers compound significantly.

Strategic Response Options

Smart food business operators are adjusting to this new reality in various ways. Source reduction is the most effective approach to cut waste. It reduces packaging volume, which helps cut disposal costs and maintains recyclable revenue. Many operators are reworking supplier agreements. They aim to minimize packaging or switch to reusable alternatives. These are the folks who are thinking ahead!

Smart food business operators are adjusting to this new reality in various ways. Source reduction is the most effective approach to cut waste. It reduces packaging volume, which helps cut disposal costs and maintains recyclable revenue. Many operators are reworking supplier agreements. They aim to minimize packaging or switch to reusable alternatives. These are the folks who are thinking ahead!

Contamination prevention becomes even more critical during low-value periods. Clean recyclables fetch higher prices than contaminated ones. Proper training helps keep the value in waste streams intact. Teaching staff the right sorting procedures is a wise investment, especially when margins are tight.

How Government Rules Can Help

Every year, $6.5 billion worth of recyclable materials get thrown away in American landfills. That’s a massive waste of money and resources (and possible jet skis). New government programs could fix this problem and make recycling more profitable.

Two types of programs show promise. Extended Producer Responsibility (EPR) makes companies responsible for their packaging waste. Deposit return schemes (we’re not sure why the word “scheme” is used here — it sounds kind of dubious) give people money back for returning bottles and cans. These programs create a steady demand for recyclables, which helps maintain stable prices.

Food business owners are starting to speak up about this issue. They’re working with trade groups to push for laws that support recycling. These laws can improve recycling facilities and create stable markets for recyclables.

What Smart Businesses Are Doing Now

The best food businesses aren’t just complaining about lower recycling prices. They’re taking action. Here are the specific steps they’re taking right now:

The best food businesses aren’t just complaining about lower recycling prices. They’re taking action. Here are the specific steps they’re taking right now:

They review waste contracts. Operators who are on the ball contact different hauling companies and request quotes. They compare current costs versus what’s available. Many businesses are saving by switching.

They’re contacting recycling facilities within a 50-mile radius. They ask about current buying prices for cardboard, plastic, and metal. They drive the extra distance if it means getting more money per ton.

“Clean cardboard only” programs are becoming a thing. They train staff to keep food waste away from cardboard boxes. Clean cardboard sells for $10 to $15 more per ton than contaminated boxes.

They join local restaurant associations. Other food business owners share real pricing information and recommend reliable haulers. Monthly meetings often include updates on waste management.

Reduce. Reuse. Rethink.

Lower recycling prices are the new reality for food businesses. Companies need to adapt rather than simply waiting for things to improve. The businesses that take action now will be in the best position when prices rise again.

Forward-thinking business owners are reducing their packaging (and not focusing solely on new animal-shaped jars). They keep recyclables clean and build strong ties with recycling companies. These steps help them save money even when recycling prices are low.

Yes, times are tough right now. However, innovative businesses view this as an opportunity to find more effective ways to manage waste and reduce costs. The companies that succeed will be those that don’t rely on high recycling prices to generate revenue. It’s about weathering the storm but doing so with confidence.

The bottom line is simple: continue to do the right thing for the environment while finding ways to protect your profits. This approach will help your business succeed no matter what happens to the prices of recyclables. After all, we’re all just trying to maintain our margins while keeping Captain Planet happy.

Are you interested in learning more about recycling and sustainability? Visit our Learning Center today and explore a wide range of topics.